What is a holding company?

A holding company is a form of business organization in which companies are united under the management of a single, large holding company. The purpose of creating a holding company is to share resources and optimize management, thereby achieving economies of scale and increasing profits.

A holding company can be formed in various ways. For example, a large company can acquire another company and merge it with itself. This approach allows the parent company to manage several companies, increasing its market potential.

Another option is to create a holding company by merging several companies whose activities complement each other. In this case, each company continues to operate in its own field, but under the overall management of the holding company. This allows the companies to access new resources and expand their business through the synergies created by the merger.

Another way to form a holding company is to attract investors. A holding company can be created by merging several companies that have invested in a common business project. In this case, the holding company is managed by professional management, who coordinate the work of all companies within the holding company.

In any case, forming a holding company is a long-term and complex process that requires high qualifications and business understanding from all participants. However, a successfully established holding company can become a powerful player in the market and provide its companies with significant competitive advantages.

Examples of holding companies

The business world is home to numerous large holding companies that own subsidiaries across various industries. These companies play a vital role in the global economy and have a significant impact on the lives of millions of people around the world.

One of the largest holding companies in the world is Alphabet Inc., which was created in 2015 as a result of the restructuring of Google Inc. Alphabet owns companies such as Google, YouTube, Android, Google Cloud, and others.

Another major holding company is Berkshire Hathaway, founded by Warren Buffett. The company owns brands such as Geico, Duracell, Dairy Queen, and Fruit of the Loom, and also has significant investments in other major companies such as Apple, Coca-Cola, American Express, and Wells Fargo.

Also worth noting is the holding company Johnson & Johnson, one of the largest medical device manufacturers in the world. The company owns more than 250 subsidiaries in various medical fields, including pharmaceuticals, medical devices, diagnostics, and consumer goods.

Other major holding companies include Procter & Gamble, which owns brands such as Pampers, Tide, and Gillette; ExxonMobil, one of the world's largest oil companies; and Nestlé, which owns more than 2,000 food and beverage brands.

Holding companies thus play a vital role in the global economy and are key players in industries ranging from technology and medicine to food and oil.

Features and characteristics of a holding company

A holding company is a large company that manages several subsidiaries in various industries and regions. The holding company's core operating principle is to pool the resources of various companies to achieve a common goal and increase efficiency.

Here are some of the key features and characteristics that distinguish holdings:

- Control over multiple companies: One of the key characteristics of holding companies is that they control multiple companies, each of which may be in different industries or regions.

- Resources: Holdings use the resources of their subsidiaries to improve their efficiency and competitiveness.

- Management: Holdings have centralized management that ensures coordination between subsidiaries.

- Brand: A holding company may have its own brand, which is used to promote the products and services of all its companies.

- Financial Benefits: One of the main advantages of a holding company is that they can achieve financial benefits through economies of scale and synergies.

- Process improvement: Holdings can leverage the knowledge and experience of their subsidiaries to improve their business processes and performance.

- Risk diversification: Holdings can spread risks among their subsidiaries, which helps reduce the overall level of risk.

- Flexibility: Holdings can quickly respond to changes in market conditions and restructure their activities in accordance with new requirements.

Holding companies can vary greatly in their structure, size, and industries. However, they share common characteristics and features that make them unique and successful in business.

Types of holdings

A holding company can control companies in various industries and fields, and often aims to manage different businesses or assets, optimize business processes, and increase profitability.

Below are 7 types of holdings by area of activity.

Financial holdings. These are holding companies that invest funds in various companies and assets, including bonds, stocks, and real estate. Financial holding companies generate income from investments and manage their assets using a variety of financial instruments.

Industrial holdings. They unite companies engaged in the production and sale of goods in various industries. Industrial holdings have strong business processes and infrastructure and typically control a large market share in their industry.

Trading holdings. These are holding companies that unite retail and wholesale companies selling products of various brands. Trading holdings have a wide sales network and marketing channels that allow them to maximize their market share and control sales in various regions.

Media holdings. They unite companies involved in the production and distribution of media content, including television, radio, newspapers, and magazines. Media holdings exert significant influence on public opinion and politics, and often play a significant role in shaping public opinion.

Technological holdings. They unite companies engaged in the development and production of high-tech products and services, such as software, electronics and telecommunications.

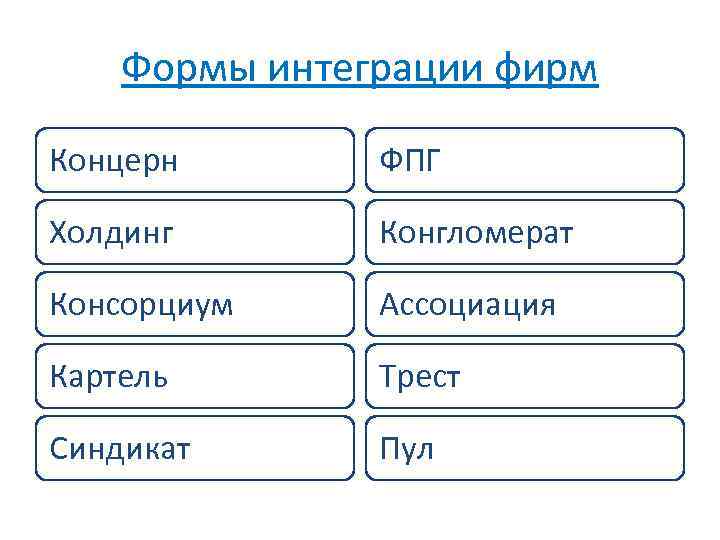

Types of holding integration

Depending on the type of integration, there are different types of holding.

Full holding

In this type of holding, the parent company fully controls its associated companies. It acquires more than 501,330 shares of other companies to gain control over management and decision-making. A full holding can also be called a vertical holding, where the companies united in the holding are involved in different aspects of the production of the same product.

Partial holding

A partial holding, as the name suggests, involves the partial integration of companies. The parent company acquires less than 50% of the shares of other companies to influence their management and make key decisions. A partial holding can be horizontal, where the companies united in the holding are engaged in similar activities, or conglomerate, where the companies are engaged in different businesses.

Mixed holding

A mixed holding combines elements of different types of holdings. It can unite companies from different industries, engage in investment and financial asset management, and also oversee production activities. Mixed holdings can be very flexible and allow companies to achieve various business goals.

Vertical holdings

Vertical holdings unite companies at different stages of the production chain. For example, a holding company may own a manufacturing facility, a distributor, and a retail network. Such holdings can be particularly effective in industries with a large number of intermediaries between the manufacturer and the end consumer. Vertical holdings typically offer advantages such as greater efficiency, better quality control, and reduced costs.

Horizontal holdings

Horizontal holdings unite companies engaged in the same type of business. For example, a holding company may own several fast-food restaurants. Such holdings can leverage economies of scale to improve efficiency and reduce costs. However, this can lead to issues with quality control and brand blurring.

Independent holdings

Independent holding companies unite companies with no similarities in their business lines. These holdings can include companies from different industries, such as finance, technology, and agriculture. Independent holding companies can use their resources and expertise to manage companies in different industries and with different goals. Such holdings can be especially useful during periods of economic crisis.

Conglomerates

Holdings and conglomerates are two terms often used in business circles, but many people don't understand the difference. While both concepts relate to corporate structure, their underlying principles and functions differ.

Holding companies are companies that control several subsidiaries, each of which operates its own business. A holding company may have an ownership stake in each of its subsidiaries, but does not directly manage them.

Instead, a holding company provides general management and financial support to each subsidiary, helping them enter new markets, grow, and compete in their industry. Examples of holding companies include Berkshire Hathaway, Alphabet Inc., and Procter & Gamble.

Conglomerates are companies that manage multiple businesses unrelated by industry. Conglomerates often bring together various companies with different goals, products, and services. Each company in the conglomerate is independent and managed independently of the other companies. Conglomerates often acquire companies that are experiencing financial difficulties but have potential for growth and development. Examples of conglomerates include General Electric, Danaher Corporation, and Berkshire Hathaway.

The difference between holding companies and conglomerates is that holding companies typically have similar business models and strategies for their subsidiaries, whereas conglomerates lack a unified business model, and each company within the conglomerate may have its own unique strategy and management model. Holding companies also often have direct management and control over their subsidiaries, whereas conglomerates do not.

Advantages and disadvantages of holdings

Holding companies can have their own advantages and disadvantages, which are important to understand when assessing their role in the economy and business.

Advantages of holdings

The first advantage of a holding company is the ability to share resources. A holding company may have better access to financial resources than individual companies. Due to its larger size, a holding company may have more favorable terms for loans and investments. This can help the companies within the holding company develop and expand more quickly. Companies united within a holding company can share experience, technology, personnel, and other resources, allowing them to operate more efficiently and cost-effectively.

The second advantage of a holding company is the ability to diversify risks. If one of the companies within the holding company experiences problems, the others can compensate. Thus, the holding company can reduce its dependence on one industry and increase its stability and reliability.

The third advantage of a holding company is the opportunity to create synergies between companies. Each company in the holding company can contribute to the overall business process, which can lead to increased productivity and reduced costs.

The fourth advantage of a holding company is the opportunity to improve management. Management of the companies within the holding company can be centralized, allowing for more effective control of all business processes and informed decision-making.

Disadvantages of holdings

One of the main disadvantages of holding companies is the loss of control over subsidiaries. When a holding company acquires a company, it becomes its owner, but the management of the subsidiaries often remains in the hands of the same people who ran it before the acquisition. This can lead to conflicts between the subsidiary's managers and the holding company's management, which can negatively impact its operations.

Another disadvantage of holding companies is the difficulty of managing a large number of companies. When a holding company owns several companies, it must manage them effectively to ensure their success and growth. This can be challenging, especially if the companies have different development directions and strategies.

Furthermore, holding companies may face competition issues. If a holding company owns several companies operating in the same industry, they may compete with each other. This can lead to lower profits and a deterioration in the holding company's reputation.

Finally, another disadvantage of holding companies is the risk of investment loss. If a holding company invests in several companies, and one of them performs poorly, this could negatively impact the holding's entire investment portfolio.

Thus, holding companies have their advantages, but also their disadvantages. When choosing this business model, companies must weigh all the possible risks and benefits to make the right choice.

Conclusion

Holdings are an important element of the modern economy and business. They allow companies to unite to achieve common goals, increase their competitiveness and growth, and expand their businesses through various strategic investments and acquisitions.

While holding companies may be criticized for their monopolistic practices and possible negative effects on market competition, they can also be beneficial to the economy and society as a whole due to their ability to innovate and their resilience to market fluctuations.

It is important for holding companies to comply with competition laws and regulations to prevent potential negative consequences for the market and consumers. Furthermore, they must strive for sustainable development and social responsibility to contribute to the creation of a favorable economic and social environment.