Определение

RFM-анализ (Recency, Frequency, Monetary) — это методика, используемая в маркетинге для сегментации клиентов на основе их покупательского поведения. Он позволяет определить, насколько недавно клиент совершил покупку (Recency), с какой частотой он делает покупки (Frequency) и какую сумму он тратит на каждую покупку (Monetary). RFM-анализ помогает идентифицировать наиболее ценных клиентов, а также разработать персонализированные маркетинговые стратегии для удержания и привлечения новых клиентов.

Recency (давность) отражает, насколько недавно клиент сделал последнюю покупку. Чем ближе дата покупки к текущему моменту, тем выше значение Recency. Цель состоит в том, чтобы идентифицировать клиентов, которые недавно совершили покупку, так как они, как правило, наиболее активны и лояльны к бренду.

Frequency (частота) указывает на то, как часто клиент совершает покупки. Чем больше покупок клиент делает, тем выше значение Frequency. Клиенты с высокой частотой покупок могут быть ценными, так как они вероятно являются лояльными и регулярными покупателями.

Monetary (сумма) отражает среднюю сумму, которую клиент тратит на каждую покупку. Чем выше сумма, тем выше значение Monetary. Клиенты, которые тратят больше денег на каждую покупку, могут быть наиболее прибыльными для бизнеса.

RFM-анализ: определение и применение в маркетинге

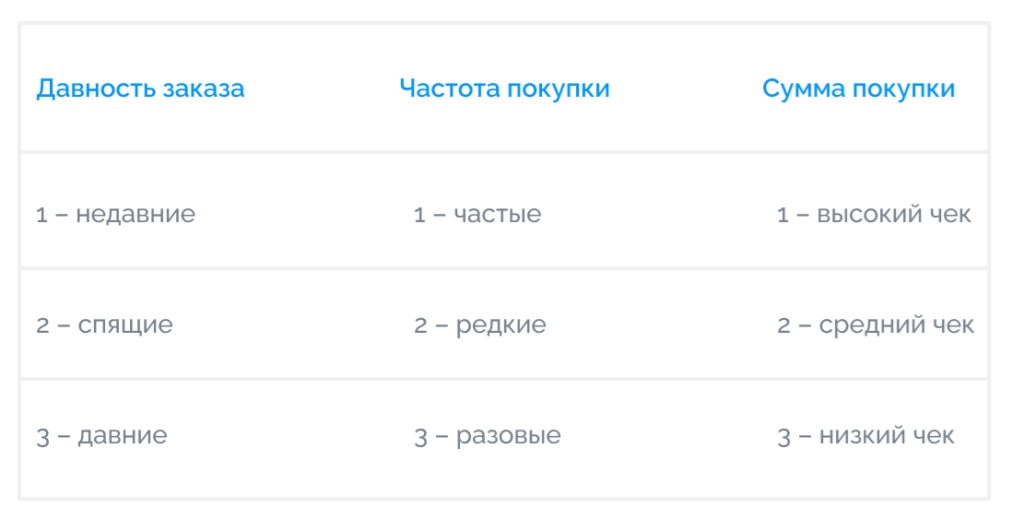

Для проведения RFM-анализа необходимо собрать и структурировать данные о клиентах, включая информацию о дате последней покупки, количестве покупок за определенный период и общей сумме затрат. Затем каждому клиенту присваиваются баллы по каждому из трех параметров в соответствии с их значениями. Например, клиенту, сделавшему покупку недавно, присваивается высокий балл по Recency.

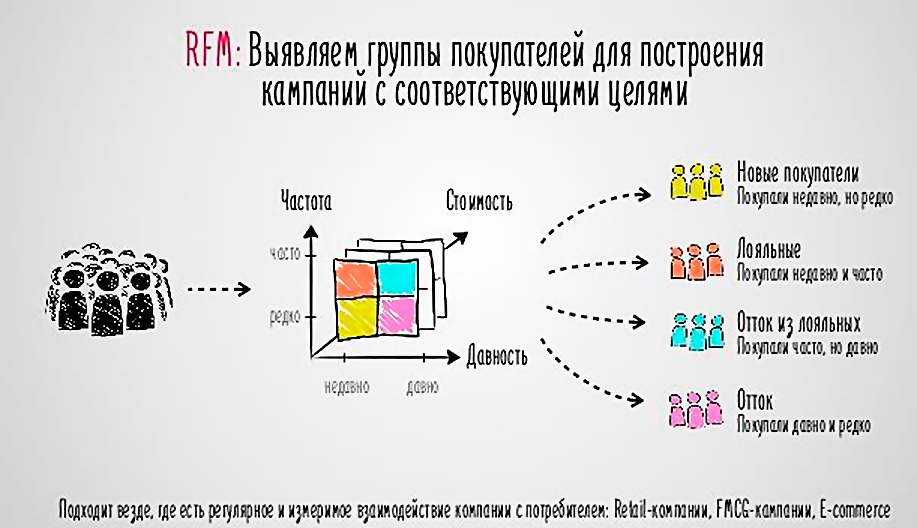

После этого происходит сегментация клиентов на основе RFM-анализа. Обычно используются квартили, чтобы разделить клиентов на группы. Например, клиенты с высокими значениями Recency, Frequency и Monetary попадают в группу «Лучших клиентов», а клиенты с низкими значениями — в группу «Потерянных клиентов».

Шаблон для эффективного анализа клиентов

Шаблон RFM-анализа в Excel состоит из нескольких листов и колонок, каждая из которых отвечает за один из параметров RFM — Recency, Frequency, Monetary. В первой колонке каждого листа указываются идентификаторы клиентов или их уникальные имена.

На листе Recency указывается дата последней покупки каждого клиента. Для удобства можно использовать формат даты, чтобы легко определить давность покупки. В колонке рядом с каждой датой можно указать формулу, которая будет автоматически считать количество дней, прошедших с даты покупки до текущего момента.

На листе Frequency указывается количество покупок, совершенных каждым клиентом за определенный период. Здесь можно просто указать число покупок в соответствующей колонке.

На листе Monetary указывается сумма, потраченная каждым клиентом на покупки. Здесь можно указать общую сумму затрат или среднюю сумму на каждую покупку

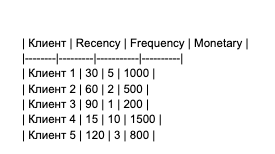

Для проведения RFM-анализа можно использовать шаблон в Excel. Вот пример шаблона, который можно использовать для анализа данных клиентов:

В этом примере мы имеем информацию о пяти клиентах и их покупательском поведении. Для каждого клиента мы указываем значения Recency, Frequency и Monetary.

После заполнения данных на каждом листе, можно приступить к проведению анализа. Для этого на каждом листе можно добавить формулы, которые будут рассчитывать баллы для каждого параметра RFM. Например, для Recency можно использовать формулу, которая будет присваивать высокий балл, если дата покупки ближе к текущему моменту, и низкий балл, если покупка была сделана давно.

Как сегментировать клиентов

После расчета баллов по каждому параметру, можно приступить к сегментации клиентов. Для этого можно использовать условное форматирование или фильтры, чтобы разделить клиентов на группы в зависимости от их баллов по Recency, Frequency и Monetary.

Шаблон RFM-анализа в Excel позволяет компаниям легко структурировать данные о клиентах и получить ценную информацию для разработки персонализированных маркетинговых стратегий. Он помогает определить наиболее ценных клиентов, которые приносят больше выручки и чаще совершают покупки. Это позволяет компаниям сосредоточить свои усилия и ресурсы на удержании и развитии этих клиентов, а также привлечении новых клиентов с похожим профилем.

Шаблон RFM-анализа в Excel является эффективным инструментом для анализа клиентов и разработки персонализированных

После заполнения данных можно приступить к анализу. Для этого можно назначить баллы для каждого из трех показателей. Например, можно использовать шкалу от 1 до 5, где 5 – самое высокое значение. Затем можно вычислить RFM-сумму, складывая значения трех показателей для каждого клиента.

После этого можно разделить клиентов на сегменты, используя квартили или другие методы разделения данных.

Например, можно разделить клиентов на три группы:

высокий RFM-сегмент

средний RFM-сегмент

низкий RFM-сегмент.

Когда клиенты разделены на сегменты, компания может разработать персонализированные маркетинговые стратегии для каждой группы. Например, для «Лучших клиентов» можно предложить эксклюзивные предложения, бонусы или скидки, чтобы удержать их и стимулировать к дальнейшим покупкам. Для «Потерянных клиентов» можно разработать программу восстановления, например, отправлять им персонализированные предложения или приглашения.Для клиентов низкого RFM-сегмента можно разработать маркетинговые активности для их вовлечения и привлечения к бренду.

Диапазоны для каждого показателя могут значительно различаться в зависимости от типа компании. Например, если ваш бизнес связан с продажей бытовой техники или мебели, то вы можете считать оценку «хорошо», если клиент совершит повторную покупку через 6 месяцев. Однако, если ваша компания занимается доставкой еды, то считать оценку «плохо» можно, если клиент не делает повторных заказов в течение 2 недель. Также важно учитывать, что суммы покупок будут различаться в зависимости от вида бизнеса. Например, для мебельного магазина сумма в 10 000 рублей может считаться низкой, в то время как для компании по доставке еды — это может быть высокий чек.

Формирование сегментов также зависит от конкретных условий и целей компании. В итоге, вы можете создать 27 различных сегментов (333) с оценками, такими как 111, 112, 113, 121, 131 и так далее, чтобы более точно анализировать и взаимодействовать с вашей аудиторией.

RFM-анализ является мощным инструментом для сегментации клиентов и разработки персонализированных маркетинговых стратегий. Он позволяет компаниям более эффективно использовать свои ресурсы, улучшить взаимодействие с клиентами и повысить уровень продаж. Используя шаблон в Excel и анализируя данные по Recency, Frequency и Monetary, вы сможете определить наиболее ценных клиентов и принять меры для удержания и привлечения новых клиентов. Благодаря RFM-анализу компании могут точнее определить свою целевую аудиторию, предлагать более релевантные предложения и улучшить общий опыт покупателей.

Иногда, для создания уникальных сегментов, достаточно учитывать всего два ключевых показателя.

Анализ RF: По «Давности» и «Частоте». Этот анализ позволяет определить, как часто ваши клиенты совершают покупки в определенный период времени. Это отличный способ выявить клиентов, которые недавно приобрели вашу продукцию и остаются постоянными клиентами.

Анализ RM: Распределение клиентов по параметрам «Давность» и «Монетизация». Этот вид анализа помогает определить клиентов, приносящих наибольшую прибыль, а также тех, кто вносит незначительный вклад в общий доход.

Анализ FM: Распределение клиентов в зависимости от «Частоты» и «Суммы» покупок. Этот метод выделяет клиентов, совершающих маленькие покупки с высокими суммами, а также тех, кто часто совершает покупки, но с небольшими чеками.

На основе полученных данных, вы сможете разработать стратегию и тактику для взаимодействия с каждым сегментом клиентской базы.

Например, в сегменте «333» будут клиенты, которые давно не покупали, сделали только одну маленькую покупку. На первый взгляд, они могут показаться менее перспективными, но не стоит их забрасывать. Ведь они хоть раз проявили интерес к вашим продуктам.

С другой стороны, сегмент «111» — это «чемпионы» вашей клиентской базы. Они часто покупают, совершают крупные покупки и последний раз покупали недавно. С такими клиентами стоит вести очень бережные отношения.

Для каждого сегмента вы можете разработать индивидуализированные предложения с особыми условиями и начать строить коммуникацию. Вы можете адаптировать коммуникацию для каждого сегмента или ограничиться несколькими приоритетными, в зависимости от ваших целей.

Как эффективно использовать RFM-методику

RFM-анализ в маркетинге — это инструмент с долгой историей, который уже несколько десятилетий помогает оптимизировать возврат на инвестиции (ROI) от рекламных кампаний. Обычно применение методики RFM в рекламе заключается в том, что для каждого сегмента аудитории создаются уникальные креативы и тексты. Этот подход также используется при необходимости классификации клиентов по их активности и характеристикам.

Сегментация клиентов — это нечто вполне стандартное в мире маркетинга. Крупные компании стремятся к максимальной детализации сегментации клиентов, а эксперты, занимающиеся этой задачей, разрабатывают четко структурированные стратегии сегментации клиентов.

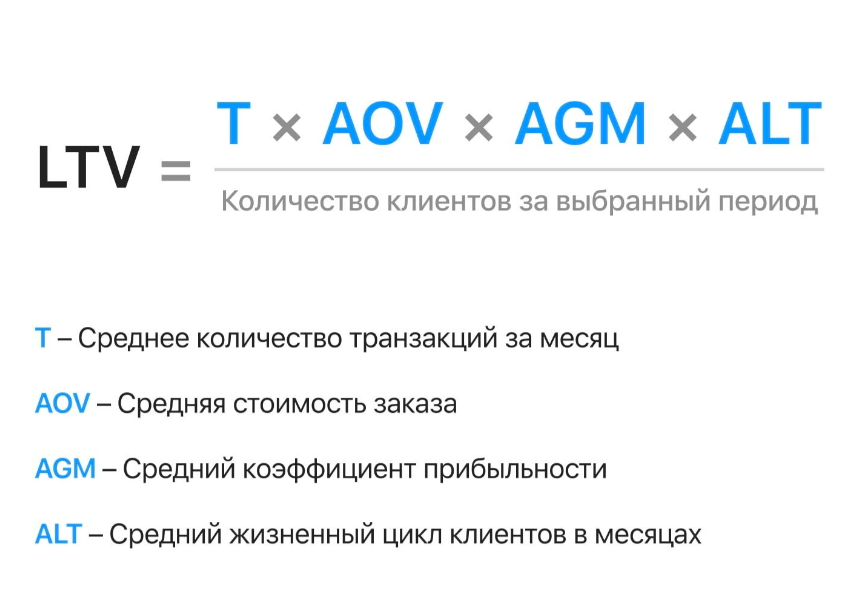

«RFM-анализ может быть вашим верным спутником в увеличении жизненной ценности клиентов (LTV). Многое зависит от того, сколько ваши клиенты готовы потратить во время всего периода взаимодействия с вашим брендом, и здесь RFM-анализ приходит на помощь. С его помощью можно уменьшить потери клиентов, продвигать дополнительные товары и услуги в наилучшие сегменты, укреплять лояльность и устраивать сарафанное радио, продавать более дорогие товары и услуги и многое другое.

Однако, следует помнить о мере. Если слишком часто обращаться к одному и тому же сегменту клиентов, можно вызвать раздражение и потерю клиентов.

Плюсы и минусы

Успех применения RFM-анализа в маркетинге подтвержден огромным числом успешных кейсов, предоставленных ритейлерами, предпринимателями в области HoReCa, бьюти-индустрии и другими профессионалами в сфере предпринимательства.

Преимущества RFM-анализа

RFM применим в различных секторах, включая e-commerce, сферу общественного питания, индустрию красоты, розничную торговлю и другие;

RFM позволяет более глубоко понять каждый сегмент и каждого клиента в частности, выявляя ваших лучших покупателей;

RFM способствует разработке высокоэффективных таргетированных рекламных кампаний;

RFM помогает улучшить клиентский опыт и повысить лояльность;

В сочетании с другими маркетинговыми инструментами RFM обеспечивает детальный анализ клиентов и выводы на его основе;

RFM сокращает расходы на маркетинг путем оптимизации целевой аудитории;

Снижает процент негативных реакций клиентов на рекламу путем оптимизации целевой аудитории.

Ограничения RFM-анализа

Результаты RFM-анализа нельзя применять к клиентам, совершившим всего одну покупку;

Если ваша продукция ограничивается одноразовыми продажами, RFM-анализ может оказаться неинформативным;

RFM-анализ базируется на доступных данных о покупках и не применим к потенциальным клиентам;

Расчеты RFM вручную могут быть времязатратными, особенно при большом объеме клиентской базы;

Слишком интенсивная реклама для одного сегмента может привести к перенасыщению и снижению эффективности маркетинговых кампаний.

RFM-анализ, несомненно, является мощным и важным инструментом для маркетологов и предпринимателей, стремящихся лучше понять своих клиентов и оптимизировать свои маркетинговые стратегии. Этот метод позволяет классифицировать клиентов на основе их активности и покупательского поведения, что в свою очередь способствует более точной и персонализированной коммуникации.

Преимущества RFM-анализа явно видны: возможность создания высокоцелевых рекламных кампаний, улучшение клиентского опыта, оптимизация маркетинговых расходов и увеличение лояльности клиентов. Важно помнить, что RFM-анализ — это лишь один из инструментов в арсенале маркетолога, и его успешное применение требует тщательного анализа и интеграции с другими маркетинговыми стратегиями.

Однако, как и в случае любого инструмента, RFM-анализ имеет свои ограничения, включая ограниченную применимость в некоторых сценариях. Кроме того, он требует доступа к данным о клиентах и тщательного анализа. Тем не менее, при правильном использовании RFM-анализ способен значительно улучшить маркетинговые усилия и повысить эффективность кампаний.

В завершение, можно сказать, что RFM-анализ остается важным инструментом для маркетологов и бизнес-лидеров, способствующим более глубокому пониманию клиентов и сознательному взаимодействию с ними. Его успешное применение помогает улучшить результаты и повысить удовлетворенность клиентов, что, в конечном итоге, может привести к росту прибыли и успеху компании.