Definition

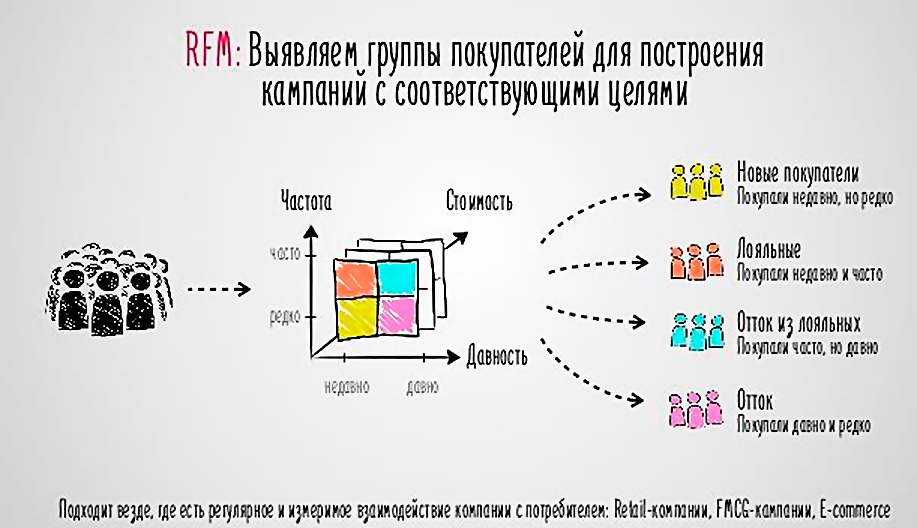

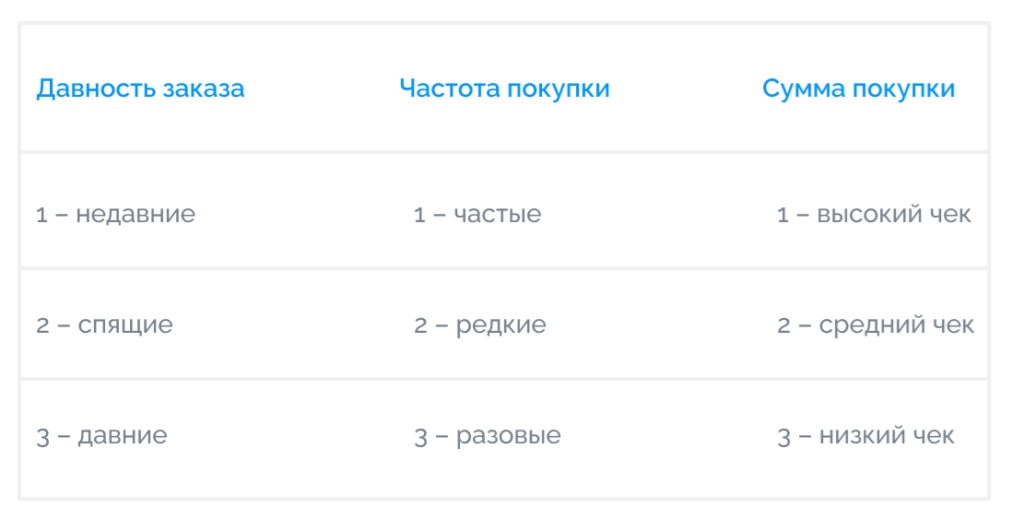

RFM (Recency, Frequency, Monetary) analysis is a marketing technique used to segment customers based on their purchasing behavior. It allows one to determine how recently a customer made a purchase (Recency), how often they purchase (Frequency), and how much they spend on each purchase (Monetary). RFM analysis helps identify the most valuable customers and develop personalized marketing strategies for customer retention and acquisition.

Recency reflects how recently a customer made their last purchase. The closer the purchase date is to the current moment, the higher the recency value. The goal is to identify customers who have recently made a purchase, as they tend to be the most active and loyal to the brand.

Frequency indicates how often a customer makes purchases. The more purchases a customer makes, the higher the frequency value. Customers with a high purchase frequency can be valuable, as they are likely to be loyal and regular buyers.

Monetary (amount) reflects the average amount a customer spends on each purchase. The higher the amount, the higher the Monetary value. Customers who spend more money on each purchase can be the most profitable for a business.

RFM Analysis: Definition and Application in Marketing

To conduct RFM analysis, it's necessary to collect and organize customer data, including the date of their last purchase, the number of purchases over a given period, and the total amount spent. Each customer is then assigned a score for each of the three parameters based on their values. For example, a customer who made a recent purchase is assigned a high Recency score.

Customer segmentation is then performed based on RFM analysis. Quartiles are typically used to divide customers into groups. For example, customers with high Recency, Frequency, and Monetary values are classified as "Best Customers," while those with low values are classified as "Lost Customers."

A template for effective customer analysis

An RFM analysis template in Excel consists of several sheets and columns, each representing one of the RFM parameters: Recency, Frequency, and Monetary. The first column of each sheet contains customer IDs or their unique names.

The Recency sheet displays the date of each customer's last purchase. For convenience, you can use a date format to easily determine how recent a purchase was. In the column next to each date, you can enter a formula that will automatically calculate the number of days elapsed from the purchase date to the current date.

The Frequency sheet displays the number of purchases made by each customer over a given period. Here, you can simply enter the number of purchases in the corresponding column.

The Monetary sheet displays the amount spent by each customer on purchases. Here you can enter the total amount spent or the average amount per purchase.

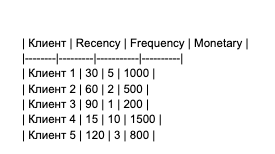

An Excel template can be used to conduct an RFM analysis. Here's an example template that can be used to analyze customer data:

In this example, we have information about five customers and their purchasing behavior. For each customer, we specify the Recency, Frequency, and Monetary values.

After filling in the data on each sheet, you can begin analyzing it. To do this, you can add formulas to each sheet that will calculate scores for each RFM parameter. For example, for Recency, you could use a formula that would assign a high score if the purchase date is close to the current date and a low score if the purchase was made a long time ago.

How to segment customers

After calculating scores for each parameter, you can begin segmenting your customers. You can use conditional formatting or filters to divide customers into groups based on their Recency, Frequency, and Monetary scores.

An RFM analysis template in Excel allows companies to easily organize customer data and gain valuable insights for developing personalized marketing strategies. It helps identify the most valuable customers who generate the most revenue and purchase more frequently. This allows companies to focus their efforts and resources on retaining and developing these customers, as well as attracting new customers with similar profiles.

RFM analysis template in Excel is an effective tool for customer analysis and development of personalized

Once the data is entered, you can begin analysis. To do this, you can assign scores to each of the three metrics. For example, you could use a scale of 1 to 5, with 5 being the highest. You can then calculate the RFM sum by adding the values of the three metrics for each client.

Customers can then be divided into segments using quartiles or other data partitioning methods.

For example, you can divide clients into three groups:

high RFM segment

middle RFM segment

low RFM segment.

Once customers are segmented, a company can develop personalized marketing strategies for each group. For example, for "Best Customers," exclusive offers, bonuses, or discounts can be offered to retain them and encourage further purchases. For "Lost Customers," a recovery program can be developed, such as sending them personalized offers or invitations. For customers in the low-RFM segment, marketing activities can be developed to engage them and attract them to the brand.

The ranges for each metric can vary significantly depending on the type of company. For example, if your business sells appliances or furniture, you might consider a "good" rating if a customer makes a repeat purchase within six months. However, if your company delivers food, you might consider a "poor" rating if a customer doesn't make a repeat order within two weeks. It's also important to consider that purchase amounts will vary depending on the type of business. For example, for a furniture store, 10,000 rubles might be considered low, while for a food delivery company, it might be a high purchase.

Segment formation also depends on the specific conditions and goals of the company. Ultimately, you can create 27 different segments (333) with ratings such as 111, 112, 113, 121, 131 and so on to more accurately analyze and engage with your audience.

RFM analysis is a powerful tool for customer segmentation and developing personalized marketing strategies. It allows companies to use their resources more efficiently, improve customer engagement, and increase sales. Using an Excel template and analyzing data by Recency, Frequency, and Monetary, you can identify your most valuable customers and take steps to retain and attract new ones. With RFM analysis, companies can more accurately define their target audience, offer more relevant offers, and improve the overall customer experience.

Sometimes, to create unique segments, it is enough to consider just two key indicators.

RF Analysis: By "Recency" and "Frequency." This analysis allows you to determine how often your customers make purchases in a given time period. It's a great way to identify customers who recently purchased your products and remain loyal customers.

RM Analysis: Client distribution by "Repeatability" and "Monetization" parameters. This type of analysis helps identify the clients who generate the most profit, as well as those who contribute little to overall revenue.

FM Analysis: Customer distribution based on purchase frequency and amount. This method identifies customers who make small purchases but high amounts, as well as those who make frequent purchases but with small purchases.

Based on the data you receive, you can develop a strategy and tactics for interacting with each segment of your customer base.

For example, the "333" segment will include customers who haven't purchased in a while and have only made one small purchase. At first glance, they may seem less promising, but don't dismiss them. After all, they've at least once shown interest in your products.

On the other hand, the "111" segment is the "champions" of your customer base. They shop frequently, make large purchases, and have recently made a purchase. These customers require careful management.

For each segment, you can develop customized offers with specific terms and conditions and begin building communications. You can tailor communications for each segment or limit them to a few priority ones, depending on your goals.

How to effectively use the RFM method

RFM analysis in marketing is a long-standing tool that has been helping optimize the return on investment (ROI) of advertising campaigns for decades. Typically, RFM analysis is applied to advertising by creating unique creatives and texts for each audience segment. This approach is also used to classify customers based on their activity and characteristics.

Customer segmentation is a fairly standard practice in the marketing world. Large companies strive for maximum detail in customer segmentation, and experts dedicated to this task develop clearly structured customer segmentation strategies.

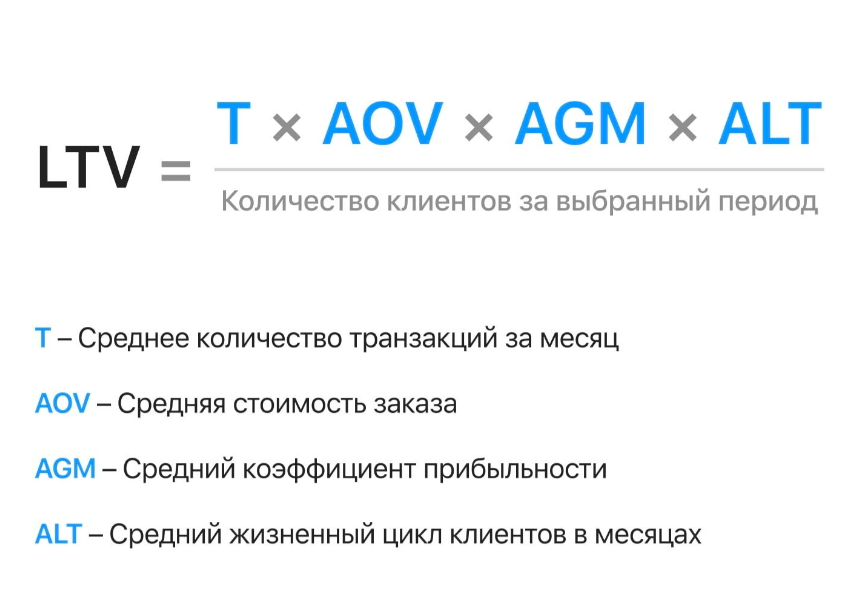

RFM analysis can be your trusted companion in increasing customer lifetime value (LTV). Much depends on how much your customers are willing to spend over the entire interaction with your brand, and this is where RFM analysis comes in handy. It can help you reduce customer attrition, promote additional products and services to the best segments, strengthen loyalty and generate word-of-mouth, upsell products and services, and much more.

However, moderation is key. Addressing the same customer segment too often can lead to irritation and customer loss.

Pros and cons

The success of RFM analysis in marketing is confirmed by a huge number of successful cases provided by retailers, entrepreneurs in the HoReCa and beauty industries, and other business professionals.

Advantages of RFM analysis

RFM is applicable in various sectors, including e-commerce, food service, beauty industry, retail and others;

RFM allows you to understand each segment and each customer in greater depth, identifying your best customers;

RFM facilitates the development of highly effective targeted advertising campaigns;

RFM helps improve customer experience and increase loyalty;

When combined with other marketing tools, RFM provides detailed customer analysis and insights;

RFM reduces marketing costs by optimizing target audiences;

Reduces the percentage of negative customer reactions to advertising by optimizing the target audience.

Limitations of RFM Analysis

The results of RFM analysis cannot be applied to customers who have made only one purchase;

If your product is limited to one-time sales, RFM analysis may not be informative;

RFM analysis is based on available purchase data and is not applicable to potential customers;

Manual RFM calculations can be time-consuming, especially with a large customer base;

Advertising too intensively to one segment can lead to oversaturation and reduced effectiveness of marketing campaigns.

RFM analysis is undoubtedly a powerful and important tool for marketers and entrepreneurs seeking to better understand their customers and optimize their marketing strategies. This method allows for the classification of customers based on their activity and purchasing behavior, which in turn facilitates more accurate and personalized communications.

The benefits of RFM analysis are clear: the ability to create highly targeted advertising campaigns, improve customer experience, optimize marketing spend, and increase customer loyalty. It's important to remember that RFM analysis is just one tool in a marketer's arsenal, and its successful application requires careful analysis and integration with other marketing strategies.

However, like any tool, RFM analysis has its limitations, including limited applicability in some scenarios. Furthermore, it requires access to customer data and careful analysis. Nevertheless, when used correctly, RFM analysis can significantly improve marketing efforts and increase campaign effectiveness.

In conclusion, RFM analysis remains an essential tool for marketers and business leaders, fostering a deeper understanding of customers and consciously engaging with them. Its successful application helps improve results and customer satisfaction, which can ultimately lead to increased profits and company success.